san francisco gross receipts tax instructions

If you pay over a certain amount in payroll expense or earn a certain amount in gross receipts you must submit a final payroll expense and gross receipts tax filing with payment to ttx. Taxpayers deriving gross receipts from business activities both within and outside San Francisco must generally allocate andor apportion gross receipts to San Francisco using rules set forth in.

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Dial 3-1-1 within SF.

. Line 1 San Francisco Gross Receipts. However the gross receipts of an airline or other person engaged in the. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross Receipts Tax. In the 1970s the City added the payroll expense tax and allowed businesses to pay either the payroll tax or the gross receipts tax the so-called alternative method the constitutionality of which the City was later challenged for in court in 1999. The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. This Program aims to assist businesses with the implementation of the Gross Receipts Tax and Business Registration Fees Ordinance approved by voters in 2012. Annual Business Tax Return Instructions 2020 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

Line 2 Receipts Subject to the Commercial Rents Tax. City and County of San Francisco. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Loaner Car Agreement Template Free Printable Rental Agreement Templates Lease Agreement Payroll Template. For the business activity selected enter the.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component and an increasing gross receipts tax. For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate. Tax and homelessness gross receipts tax that would otherwise be due on april 30 2020 are waived for.

SAN FRANCISCO RESIDENTIAL RENT ASSISTANCE PROGRAM FOR PERSONS DISQUALIFIED FROM FEDERAL RENT SUBSIDY PROGRAMS BY THE FEDERAL QUALITY HOUSING AND WORK RESPONSIBILITY ACT OF 1998 QHWRA. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio. Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways.

City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Greater than 3001 a 03 overpaid executive tax rate.

San Francisco Gross Receipts Tax Instructions 2020. As noted in section 40116b of title 49 of the United States Code Section 40016b the Gross Receipts Tax in Article 12-A-1 of the San Francisco Business and Tax Regulations Code shall not apply to the gross receipts from that air commerce or transportation as that phrase is used in Section 40016b. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other.

The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other guidance addressing major changes to how owners of disregarded entities are taxed combined reporting and procedures for requesting a two-month extension of time to file returns that were otherwise due March 2 2015. The last four 4 digits of your Tax Identification Number. Administrative and Support Services.

Your seven 7 digit Business Account Number. 1 The existing payroll expense tax is being phased out in increments consistent with the phase-in of the gross receipts tax over a. To begin filing your 2020 Annual Business Tax Returns please enter.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of. Your seven 7 digit Business Account Number. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

Persons and combined groups with more than 50000000 in combined taxable San Francisco gross receipts are required to file and pay the Homelessness Gross Receipts Tax. To avoid late penaltiesfees the returns must be submitted and paid on or before Feb. This number will be pulled from the Gross Receipts Tax filing.

Payroll Expense Tax Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for. After the pop up box is closed the sum of the Total within and outside San Francisco and the sum of the Total within San Francisco will display in line 14 on Gross Receipts Page.

Line 15 Excludable Taxes. Annual Business Tax Returns 2021 File by Feb. Gross Receipts Tax Applicable to Private Education and Health Services.

Secured Property Taxes Treasurer Tax Collector

Wells Fargo Cashiers Check Psd Template With Regard To Cashiers Check Template Best Professional Template Business Model Template Wells Fargo Psd Templates

Tax Forms Tax Forms Irs Taxes Tax

California San Francisco Business Tax Overhaul Measure Kpmg United States

Annual Business Tax Returns 2020 Treasurer Tax Collector

Homelessness Gross Receipts Tax

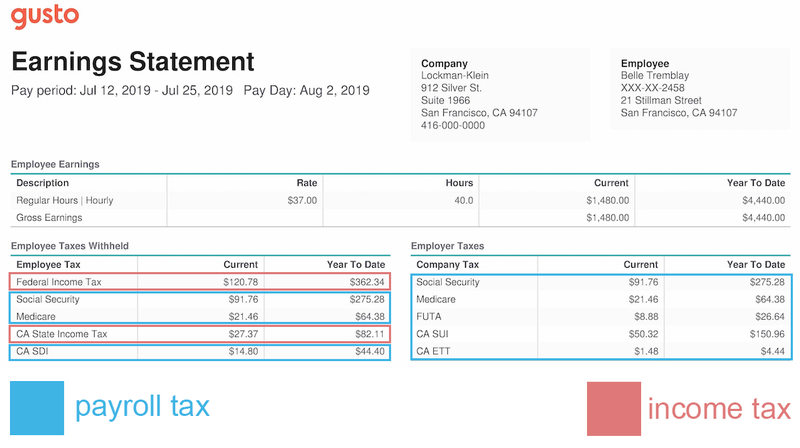

Different Types Of Payroll Deductions Gusto

Browse Our Example Of Direct Deposit Authorization Form Template Payroll Direct Instruction Project Management Templates

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

Free Business Income And Expense Tracker Worksheet Small Business Expenses Business Budget Template Spreadsheet Business

Payroll Tax Vs Income Tax What S The Difference

Overpaid Executive Gross Receipts Tax Approved Jones Day

San Francisco Taxes Filings Due February 28 2022 Pwc

Homelessness Gross Receipts Tax

Due Dates For San Francisco Gross Receipts Tax

Renters Lease Agreement Real Estate Forms Rental Agreement Templates Lease Agreement Lease Agreement Free Printable