arkansas estate tax return

Free Real Estate and Tax information search and a website link to the State Land Commissioner can be found below under Additional Information. First State Bank of Crossett Arkansas v.

Arkansas Estate Tax Everything You Need To Know Smartasset

Department of the Treasury Internal Revenue Service Center Kansas City MO 64999.

. Return to top of page. The child care credit which is equal to 20 of the federal child care credit. 8939 historical form only Department of the.

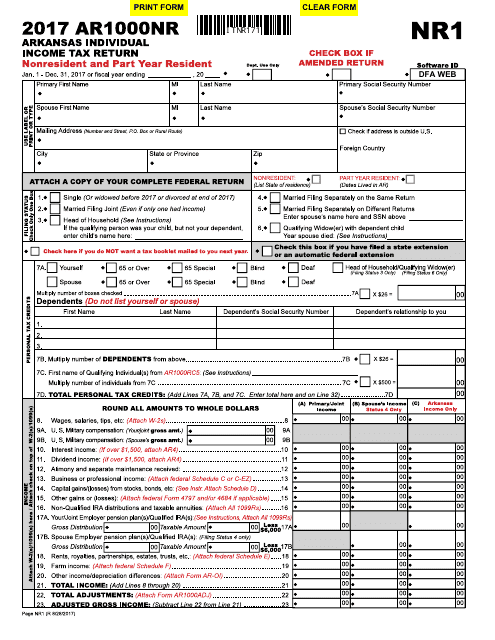

For questions about individual state income tax there are a few ways you can get help. Welcome to the Arkansas Assessment Coordination Divisions website. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL.

Try our FREE income tax calculator. Are charged at a higher sales tax rate. Start filing your tax return now.

Arkansas the corporation should enter the Little Rock address. TAX DAY NOW MAY 17th - There are -385 days left until taxes are due. Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the.

The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. In order to make changes corrections or add information to an income tax return that has been filed and accepted by the IRS or state tax agency you must file a tax amendment to correct your returns. Code states that federal tax returns and return information shall be confidential This extends to any of the information related to the returns such as reviews audits and any effort to collect unpaid taxes.

Otherwise your canceled check will serve as your receipt. The following is a discussion of tax return confidentiality and disclosure laws. Were originally developed for real estate development ventures.

Income Tax Return for Real Estate Investment Trusts to report the income gains losses deductions credits certain penalties and to figure the income tax liability of a REIT. Other Arkansas credits include the political contribution credit of up to 50 per year. Oregons sales tax rates for commonly exempted items.

Are required to file informational returns with the Internal Revenue Service and Arkansas Income Tax Division. Sheridan Arkansas 72150 Phone. Are created by filing a Certificate of Limited Partnership with the Secretary of State.

Arkansas has some of the highest sales taxes in the country. Tax Return Confidentiality and Federal Law. If a Washington estate tax return is filed and a Federal estate return is filed a copy of IRS Form 706 must be submitted with.

When the gross estate exceeds the exemption an estate tax return should be filed even when there is no estate tax liability. Prescription Drugs are exempt from the Arkansas sales tax. The section 6324a2 personal liability arises independently of the estate tax lien.

The Arkansas Department of Finance and Administration handles all state tax issues. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals. Use Form 1120-REIT US.

When the gross estate is less than the filing threshold no estate tax return is required. The OR sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. The statewide rate is 65.

Envelope in which to return it. What are some basics of Arkansas state taxes. Check your refund status at.

870 942- 8007 email protected. These additional measures may result in tax refunds not being issued as quickly as in past years. United States 410 US.

And the credit for adoption expenses also 20 of the federal credit. Must file an annual report with the Arkansas Secretary of State. Calling the DFA or its tax hotline at 1-501-682-1100 or 1-800-882-9275.

Rather it is 10 years from the date the assessment is made against the estate upon the filing of the estate tax return in accordance with IRC 6502a. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915. Hi Michele with that kind of capital gain you really need to speak with an accountant.

They may charge you 500-1000 to prepare your return but theyll save you 5000 in taxes. Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12. As a division of the Arkansas Department of Finance and Administration our mission is to efficiently promote and oversee fair equitable and uniform property tax treatment for all taxpayers local government officials and school districts within and across all seventy-five Arkansas counties.

One year from the final determination of the amended federal return or federal change whichever is later provided that the allowable refund is not more than the decrease in Arkansas tax attributable to the federal change or correction. Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files. Three years from the due date of the original tax year return including valid filing extensions.

You can go back to preparing your own tax return next year.

Free Arkansas Special Warranty Deed Form Pdf Word Eforms

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Where S My Refund Arkansas H R Block

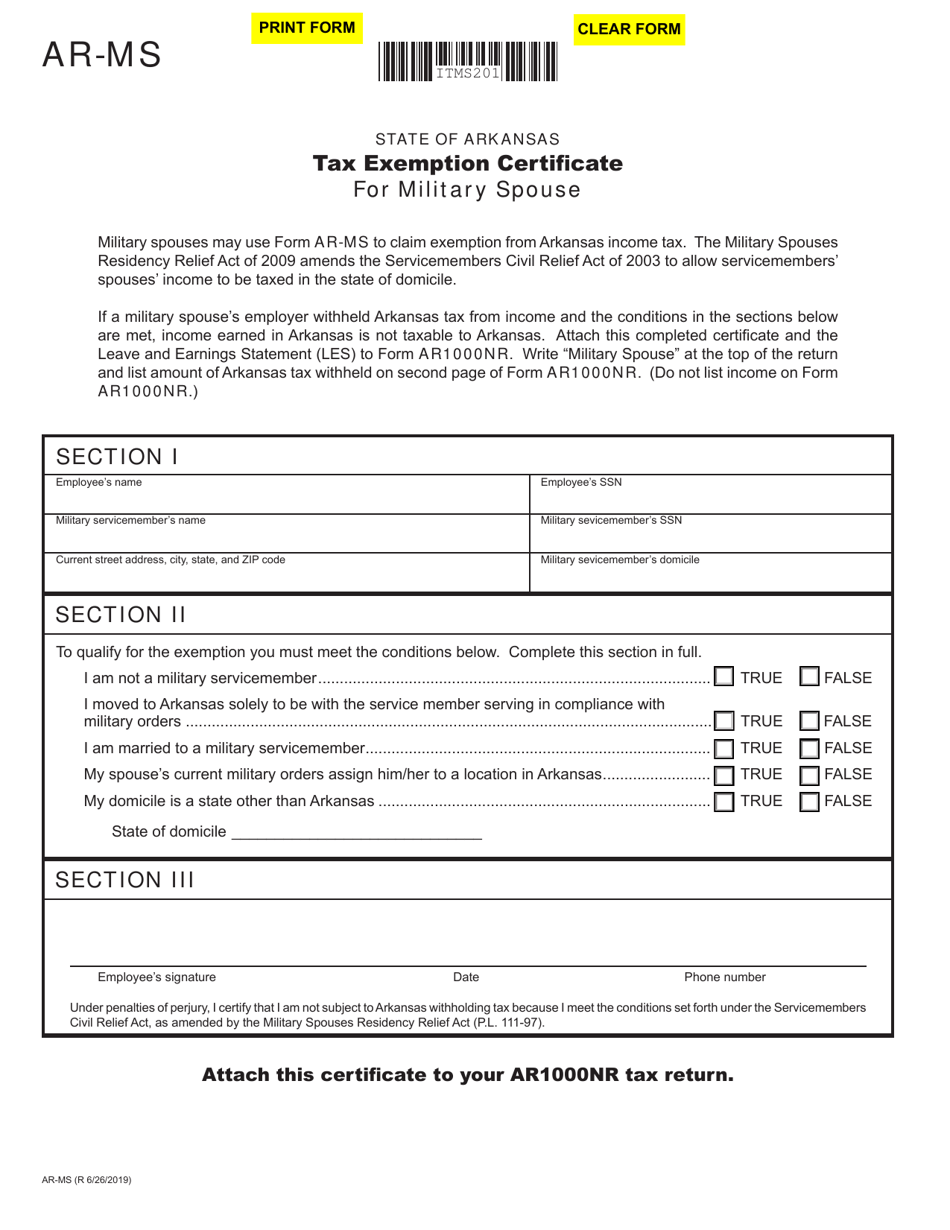

Form Ar Ms Download Fillable Pdf Or Fill Online Tax Exemption Certificate For Military Spouse Arkansas Templateroller

Arkansas State Tax Information Support

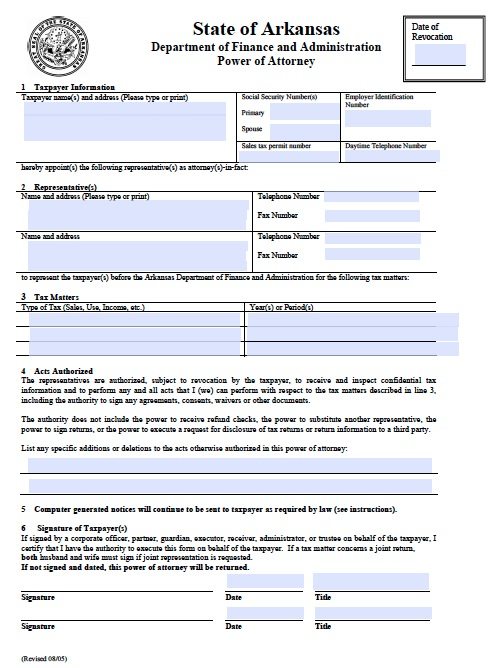

Free Tax Power Of Attorney Arkansas Form Fillable Pdf

Arkansas Franchise Tax Instructions Fill Online Printable Fillable Blank Pdffiller

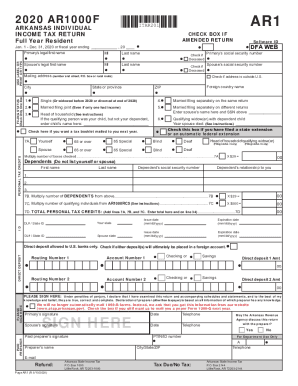

Arkansas State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Arkansas State Tax Return Fill Online Printable Fillable Blank Pdffiller

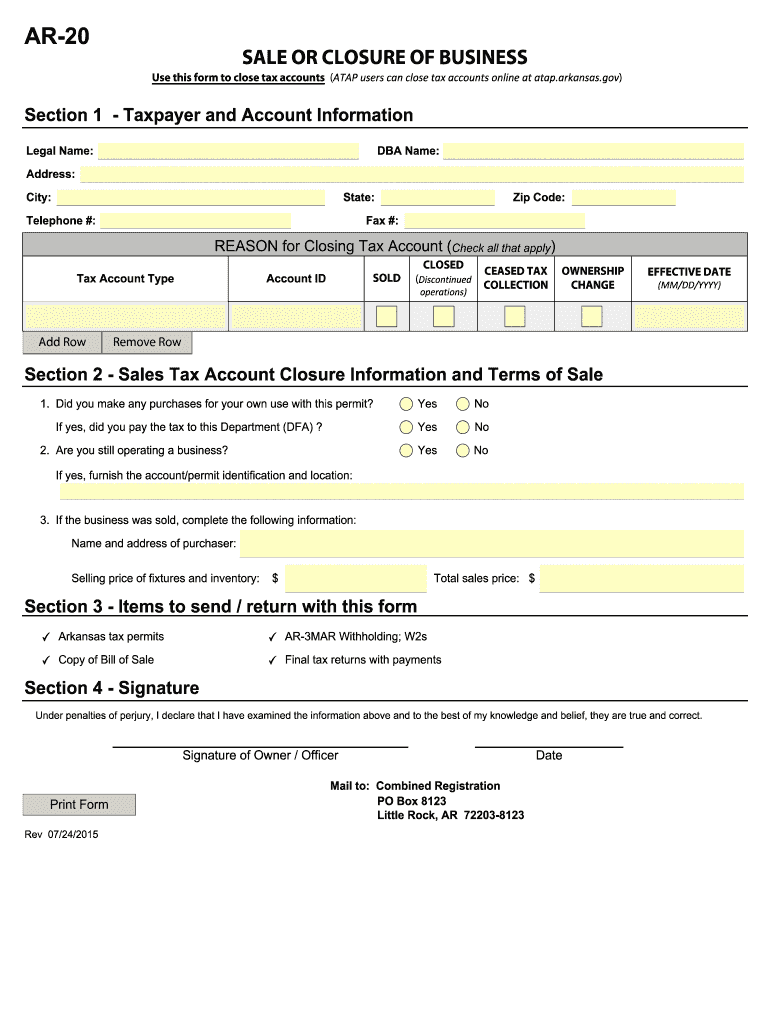

Ar Ar 20 2015 2022 Fill Out Tax Template Online Us Legal Forms

Arkansas Estate Tax Everything You Need To Know Smartasset

30 Day Notice To Vacate Pdf Rental Property Management Real Estate Investing Rental Property Real Estate Management

Arkansas Excise Tax Return Et 1 Form Fill Online Printable Fillable Blank Pdffiller

Filing An Arkansas State Tax Return Things To Know Credit Karma Tax

The Ultimate Guide To Arkansas Real Estate Taxes

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Form Ar1000nr Download Fillable Pdf Or Fill Online Arkansas Individual Income Tax Return Nonresident And Part Year Resident 2017 Arkansas Templateroller